How to Reduce Marketplace Health Insurance Costs

Discover how to reduce the amount you must pay.

If you are not covered by an employment, a spouse’s or parent’s plan, or another source of health insurance, the Health Insurance Marketplace may be your best option.

Furthermore, looking through the Marketplace for a plan is essential if you’re living on a tight budget. You can be eligible for additional savings that cut your monthly health insurance premium, deductible, copayment, and coinsurance costs.

KEY LESSONS

If you don’t have health insurance through a job, spouse, Medicare, Medicaid, or the Children’s Health Insurance Program, you can purchase a plan on the Health Insurance Marketplace (CHIP).

•

Bronze, Silver, Gold, and Platinum are the four tiers into which plans are divided by the Marketplace. Platinum has the greatest monthly cost but the broadest coverage, whereas Bronze has the lowest monthly cost but the least coverage.

• If you have a low income, you might be able to use tax credits and subsidies to lower the cost of your health insurance.

• You could be eligible to purchase a catastrophic plan with reduced monthly premiums if you’re under 30 (or qualify for a hardship exemption).

Marketplace for Health Insurance

You can purchase a plan on the Health Insurance Marketplace if you do not have access to health insurance through your employment, Medicare, Medicaid, the Children’s Health Insurance Program (CHIP), or another source.

You must meet the following requirements in order to be eligible to enroll in health coverage through the Marketplace:

• Must be a citizen or national of the United States (or be lawfully present)

• Must not be incarcerated

You are not eligible to purchase a health or dental plan through the Marketplace if you have Medicare coverage.

The Affordable Care Act (ACA) of 2010, sometimes referred to as Obamacare, included the creation of the Marketplace (or Exchange). The majority of people can apply for and enroll in health insurance through the federal government’s marketplace (which can be accessed at HealthCare.gov), but 17 states and Washington, D.C. have set up their own exchanges.

If you reside in, you will enroll through a state health marketplace.

California, Colorado, Connecticut, District of Columbia, Idaho, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Nevada, New Jersey, New Mexico, New York, and Pennsylvania

Rhode Island, Vermont, and Washington

Marketplace Plans’ Required Coverage

No matter who you are or what level of income you have, marketplace plans guarantee that you will receive a specified minimum level of health care. You also have some privileges as a Marketplace customer.

One is that if you have a pre-existing ailment, an insurance provider cannot refuse you coverage (or charge you extra). Another is that even if you haven’t reached your deductible yet, preventative care (things like regular checks and screenings) is covered at 100%.

The following essential health benefits must be included in every plan sold on the Marketplace:

• Patient ambulatory services

Coverage for breastfeeding

• Emergency services • Family planning coverage • Hospitalization • Laboratory services • Care for newborns and children (including dental and vision care)

• Mental health and substance use disorder treatments • Occupational and physical therapy • Pregnancy, maternity, and newborn care • Prescription pharmaceuticals

• Services for chronic disease management and prevention

Preventative treatments include, but are not limited to: Alcohol abuse screening and counseling; Blood pressure screening; Cholesterol screening; Colorectal cancer screening; Depression screening

• Diagnosis of Type 2 diabetes

HIV testing, immunizations, mammograms, and obesity screening

When to Submit a Coverage Application

If you experience a qualifying occurrence, you can be eligible for a special enrollment period. It occurs if one of the following occurs:

• You lose your current health coverage (such as from losing your job).

• You get married or divorced.

• You become pregnant or adopt a child.

• You relocate to a different county or ZIP code.

• Your insurance coverage is impacted by a change in your income.

If not, you must look for, apply for, and purchase a health insurance plan during the open enrollment period. Typically, this occurs in the fall, between November and December.

Beginning Your Business Career

Visit HealthCare.gov or the equivalent website in your state to get started. In any case, you’ll receive a brief side-by-side comparison of the plans that are offered to you.

You can select from four types of health insurance in the database: Bronze, Silver, Gold, and Platinum. When it comes to your monthly health insurance cost, bronze plans are the least expensive. Yet, their deductibles, copayments, and coinsurance are the highest. Platinum plans offer the highest monthly payments but the lowest additional fees.

It might be difficult to choose between these plans, so take your time and learn as much as you can about the advantages of the various plans before you decide.

You’ll find out if you’re eligible for a cost-sharing reduction or the advance premium tax credit throughout the enrollment process. You’ll learn how much you can save if you’re eligible. You must purchase your plan through the Marketplace if you are eligible for savings.

Health Plan Comparison

Your options on the Marketplace come from private health insurance providers including Blue Cross, Cigna, and UnitedHealthcare, among others. Where you live affects the mixture you receive.

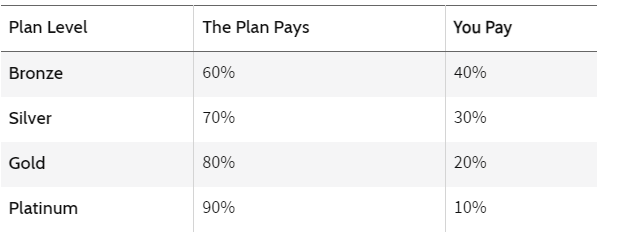

Within the four metallic levels, each corporation provides a variety of health care programs. The levels show the approximate percentage of expenditures that the plan will cover for your health care services:

For instance, bronze plans have the lowest monthly premiums but the lowest level of coverage (60%) available. The coverage and your monthly cost both grow as the plan level does.

You will be able to select from a variety of coverage options, even when you are purchasing at the same metallic level. Your premiums and out-of-pocket expenses for deductibles, copayments, and coinsurance are impacted by these choices. A plan from one company may cost more or less than the identical plan from another firm since the Marketplace allows several private insurers to offer plans.

For instance, a Silver plan from one provider may have a higher monthly deductible up front, but your out-of-pocket costs will be significantly lower. In contrast, a Silver plan from a different insurer might be less expensive per month, but you’ll pay more for health care costs due to the higher deductible, copayment, and coinsurance rates.

Ways to Lower the Prices of Insurance on the Marketplace

You may be eligible for the advance premium tax credit or a cost-sharing reduction depending on your income (or, more specifically, your modified gross adjusted income (MAGI)) and family size. Your health care costs will go down thanks to both of these initiatives.

Cost-Sharing Savings

A cost-sharing reduction is a discount that is only accessible with Silver plans. This discount can assist in lowering your out-of-pocket expenses for:

• Deductibles: the sum you must pay for covered services before your health insurance coverage begins.

• Copayments: a set amount you pay for covered health care services.

• Coinsurance: Your portion of the price of a covered health care service.

• Out-of-pocket maximum: The most you’ll pay for covered health costs in a calendar year.

Let’s imagine you go to the doctor and are charged $100. You typically have a $25 copay with your specific Silver plan. Your copay might be as little as $5 if you are eligible for cost-sharing reductions and selected a Silver plan through the Marketplace.

Similar to this, cost-sharing reductions may allow your plan’s $3,500 deductible to be reduced to $500. In essence, you pay for a Silver plan but get the expanded coverage of a higher metallic level plan, lowering your out-of-pocket costs.

Only the following individuals are eligible for cost-sharing reductions:

• Individuals who cannot obtain approved health insurance via their employment. • Persons who do not qualify for public coverage such as Medicaid or the Children’s Health Insurance Program (CHIP). You cannot receive a cost-sharing reduction if your company provides health insurance.

• Those with annual incomes that are between 100% and 250% of the federal poverty line

The cost-sharing reduction and advance premium tax credit subsidies are not given automatically: On the Health Insurance Marketplace, you must apply for them.

Credit for Advanced Premium Taxes

An advance premium tax credit, which lowers your monthly health insurance expense for coverage purchased through the Marketplace, is available to a much larger number of consumers. Any metallic level plan in the Marketplace can be selected using this credit.

You must not be able to obtain qualifying health insurance via your work in order to be eligible for the advance premium tax credit.

Typically, your income must be between 100% and 400% of the federal poverty limit.

However, the American Rescue Plan Act now makes it possible for more people to get this credit for the years 2021 and 2022. The act also enhanced the level of help for many people who already qualified.

Your health insurance receives premium tax credits directly from the government to cut your monthly payment. If you are eligible, you can choose how much of the credit (up to 100%) to use against your monthly bill.

The premium tax credits you got and the real amount you are eligible for based on your ultimate income for that year will be “reconciled” when you complete your annual tax return. You might have to pay the money back when you file your return if you received more payments than you were eligible for. But, you might be eligible for a refund if you should have taken more. 15

An online tool provided by HealthCare.gov displays the potential subsidies you may be eligible for based on your income, the number of adults and children enrolled in coverage, and your state.

The Advanced Premium Tax Credit and the American Rescue Plan Act

The American Rescue Plan Act of 2021 altered how the advance premium tax credit is applied for 2021 and 2022. For these years, the law raises premium tax credits for all income levels.

This is how it works. Historically, households with earnings more than 400% of the federal poverty line were not eligible for such tax benefits. Families that earn more than 400% of the federal poverty line are now eligible to apply for premium tax credits under the new law.

The program still has a limit, but it operates in a different way. Now, no family will contribute more than 8.5% of their household income to the cost of the benchmark plan or a less expensive plan. As a result, a large number of consumers will be eligible for larger tax credits to help pay for the premiums for Marketplace health plans.

Beginning on April 1, 2021, this extension was automatically added to all plans offered via HealthCare.gov. This indicates that the enhanced premium tax credits for 2021 Marketplace coverage will be given to new consumers and current enrollees who submit an application and choose a plan on or after April 1.

Even if you already have a marketplace plan, it is still worthwhile to see if the new premium tax credit roles can reduce the cost of your health insurance. Individuals who signed up for a plan before April 1, 2021, can refresh their application on the marketplace they used to acquire updated eligibility results. The modifications will then take effect, lowering your premiums for the rest of the year, and you can choose your current plan once more.

Be cautious, though. Your deductible will be reset if you change plans, so you might have to pay more in copayments and insurance if you’ve already reached it for the year. as though there were no such thing as as as, in the’s of the ‘.’s of the ‘e.

Catastrophic Coverage: What to Look for

You might see catastrophic plans listed as one of your plan options when you submit an application online. If you’re under 30 or qualify for a hardship exemption because you can’t afford health coverage, you might be eligible for a catastrophic plan. This is decided throughout the application process and is dependent on the size and income of your household.

Until the deductible is met, a catastrophic health plan covers three primary care visits per year. Also, it offers free preventative services to you. Although the monthly premium should be far less than those of other plans, the out-of-pocket expenses (deductibles, copayments, and coinsurance) are typically substantially greater.

If you qualify for and select a catastrophic plan, you won’t be eligible for cost-sharing reductions or premium tax credits. Premium subsidies cannot be used to purchase catastrophic insurance.

Medicaid Eligibility

You might be eligible for Medicaid, a program that offers health coverage to eligible individuals in the following categories, depending on your income and family size:

• Low-income people, families, and kids

• Women who are expecting; • Seniors; • Those with impairments

Who is eligible for Medicaid is subject to state-specific regulations. Medicaid eligibility was expanded in many states under the Affordable Care Act, and more people qualified for benefits. You won’t need to purchase a Marketplace plan if you are eligible because you can obtain free or inexpensive coverage.

The Children’s Health Insurance Program (CHIP), a distinct program offered by several states, offers health insurance to uninsured kids from low-income households who don’t qualify for Medicaid but still can’t afford private coverage.

Fill out an application on the Health Insurance Marketplace to determine if you are eligible for Medicaid or CHIP services. To apply and determine your eligibility, you can also go to the Medicaid website for your state.

What Are State Healthcare Exchanges?

State health care exchanges, commonly referred to as state health care marketplaces, let people and small companies compare and buy different types of health insurance. These policies adhere to the coverage requirements and standards specified in the Affordable Care Act, although being provided by private insurers. Residents of 17 states and the District of Columbia use these state exchanges to purchase such insurance. Through the federal government’s marketplace, Americans in other states buy health insurance.

Can I Obtain Obamacare and Decline My Employer’s Health Insurance?

Yes. Almost all Americans can now purchase individual and family health insurance through the Affordable Care Act’s online Marketplace. Be careful, though. You won’t likely be eligible for any subsidies, tax breaks, or other financial aid if you decline your employer’s offer of health insurance. If one of the following conditions holds true, you might be eligible:

1. The “minimum value standard” of coverage required by the ACA is not met by your employer’s health plan.

2. The most affordable plan offered by your company exceeds a predetermined threshold of your household income in cost.

Even without the subsidies, a Marketplace plan can be more affordable than your employer-based insurance, so constantly check the marketplace to make sure you’re not losing out on a better deal.

How Much Does Marketplace Insurance Cover?

Anyone can get Marketplace insurance; technically, there is no upper income restriction. The amount of the premium tax credit or subsidy you might be eligible for to help pay for that insurance is what is constrained by your income.

If you spend more than 8.5% of your household income on health insurance premiums in 2021 and 2022—specifically, the price of the Silver “benchmark plan”—you are eligible for subsidies (the second-lowest-cost plan on the exchange).

Conclusion

Via the Health Insurance Marketplace, the majority of people and families will be able to shop around for their 2022 health coverage.

You can check your eligibility for Medicaid, CHIP, cost-sharing reductions, and/or premium tax credits after submitting an online application. You will also learn if you are eligible for a catastrophic plan, which has higher out-of-pocket expenses but cheaper premiums.

To learn more about the Health Insurance Marketplace, further savings, state-specific information, and how to apply in your state, visit the following websites:

Call 1-800-318-2596 or go to HealthCare.gov.

• Get in touch with your existing health insurance provider